You are at: Planned Giving > Gift Options > How to Give > CGA

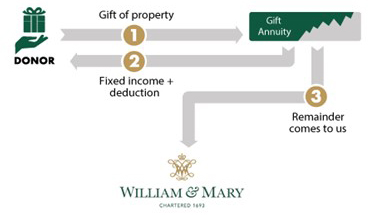

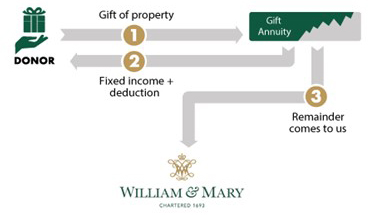

How it Works

- You transfer cash or appreciated securities to the William & Mary Foundation.

- The Foundation pays you and/or one other annuitant a fixed and guaranteed income for life.

- The remaining balance passes to the Foundation at the end of the annuity term to be used as you have directed.

Benefits

- Receive dependable, guaranteed, and fixed income for life in return for your gift.

- In many cases, the annuity rate will be higher than the yield you are receiving from stocks or CDs.

- Receive an immediate charitable tax deduction for a portion of your gift.

- A portion of your annuity payment will be tax-free.

Note

- Annuitants must be at least 65 at the time of the gift for an immediate gift annuity.

- The minimum gift amount is $25,000.