You are at: Planned Giving > Gift Options > How to Give > CRUT

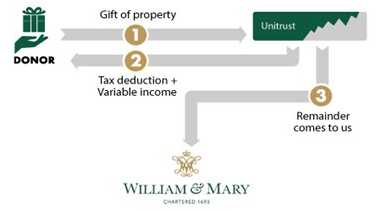

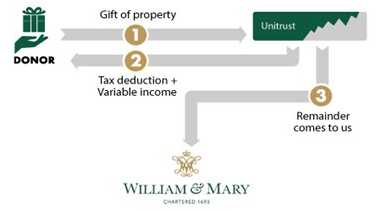

How it Works

- You transfer cash, securities or other appreciated assets (including real estate) into a trust.

- The trust pays a percentage of the value of its principal, which is valued annually, to you or the beneficiaries you name. The recommended percentage is 5%.

- When the trust terminates, the remainder passes to William & Mary to be used as you have directed.

Benefits

- Receive income for life or a term of years in return for your gift.

- Receive an immediate charitable tax deduction for a portion of your contribution.

- Pay no upfront capital gains tax on appreciated assets you donate.

- You can make additional gifts to the trust as your circumstances allow for additional income and tax benefits.

Note

- Beneficiaries must be 50 or older at the time of the gift.

- The minimum gift amount is $100,000.